is looking forward to benefitting from SWIFT’s platform and services to provide an efficient and convenient channel to the global financial community. “China International Payment Service Corp.

The MOU sets out plans for a strategic collaboration to develop China’s Cross-border Interbank Payment System (CIPS) using SWIFT as the secure, efficient and reliable channel to connect CIPS with SWIFT’s global user community. SWIFT Chief Executive of Asia Pacific and EMEA, Alain Raes and CIPS Executive Director, Li Wei signed the MOU in Beijing on 25 th March 2016. Can e-CNY be the latter? Beijing may not know the answer, but after Russia’s semi-expulsion from Swift, it might want to find out.SWIFT has signed a memorandum of understanding (MOU) with China International Payment Service Corp., (CIPS Co.). But when muscles are actually flexed, the long-term result may be unpredictable: It could either send future rivals cowering or embolden their search for an alternative. It’s unrivalled as long as the consequences of its coercive use-collapsed banking systems, tanking national currencies, swooning stock markets-are left to the imagination of potential targets. The sphere of US economic dominance could shrink-not in a year or two, but perhaps over a decade or longer.Īnd that’s probably the biggest thing about hegemonic power. Even if the US bars stablecoin firms from doing business with Chinese residents, it will not be able to prevent entities in a third country from buying dollar tokens on a crypto exchange to pay US-regulated businesses. Indeed, no Western bank may be needed to move funds across borders. Swift won’t see the transaction and Chips won’t have to clear it.

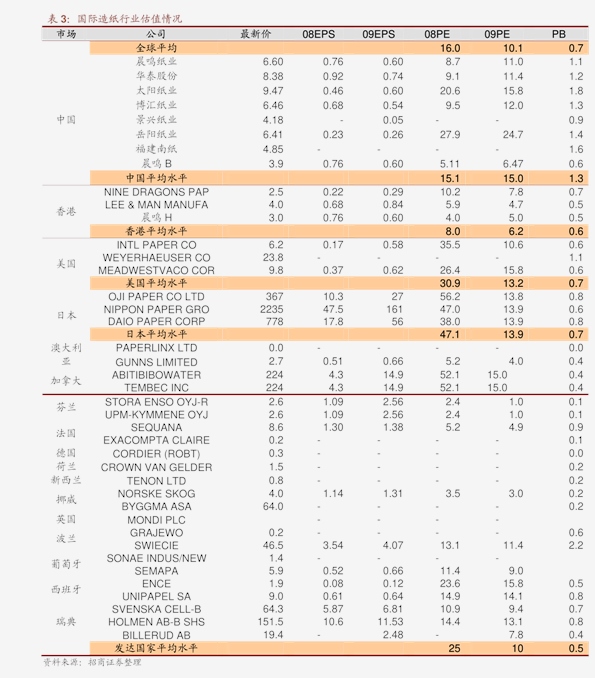

And to convert its digital yuan back into dollars-or a stablecoin like Tether or USD Coin that mimics the US dollar-the intermediary only needs people in the rest of the world to want to buy Chinese goods and assets, for which they will be required to send e-CNY. If the Chinese buyer doesn’t have valid yuan to spend, the seller won’t receive payment the go-between won’t be out of pocket. The blockchain will make all transactions ‘atomic’, meaning that money will change hands-in tokenized form-without exposing any of the counterparties to a limbo where they had parted with something of value without receiving the agreed consideration. The intermediary faces no credit risk because it’s dealing in sovereign cash, backed by taxpayers of the world’s second-biggest economy. If a Chinese company or individual were to face the threat of not being able to send money overseas because Chips won’t clear the payment or Swift won’t carry instructions, an intermediary in a friendly country could always be persuaded to accept e-CNY, and forward a dollar stablecoin payment to the Chinese buyer’s overseas counterparty. The token is “technically ready" for cross-border use, according to a white paper released by China’s central bank, though it’s “designed mainly for domestic retail payments at present." That could change. Which is where e-CNY, the digital yuan being tested, enters the picture. But as long as 40% of the world’s international payments are in dollars, a clearing facility for yuan, whose share is 3%, can’t replace Chips. To shrug off the yoke of Chips, China has readied its own Cross-Border Interbank Payment System (CIPS), which settles international claims in yuan and can potentially run its own messaging network (since 2016, it has used Swift). Huawei argued that since HSBC knew of its links with Skycom, a Hong Kong-based partner that sold equipment in Iran, the bank should have routed the funds through a smaller offshore dollar-clearing system in Hong Kong, thereby avoiding money put on US soil.

In the Canadian court battle to stop the extradition to the US of Huawei’s finance chief Meng Wanzhou, the Chinese firm questioned HSBC’s decision to process $100 million of Skycom transactions in New York. As an instrument of US power, Chips hasn’t gone unnoticed in Beijing. Millions of dollars in fees aren’t worth the nearly $13 billion that Chips members like BNP Paribas, Standard Chartered and others have paid in fines over nearly two decades of Iran-related sanction violations. They all maintain US offices and are subject to US law. Its 43 members settle $1.8 trillion in claims every day using a pre-funded account at the US Federal Reserve. The Clearing House Interbank Payments System (Chips) is a private club of financial institutions.

0 kommentar(er)

0 kommentar(er)